More customers opting for the “fourth” carrier over AT&T, T-Mobile, and Verizon

customers opting for the “fourth” carrier over AT&T, T-Mobile, and Verizon

The CEO of Comcast’s Connectivity and Platforms unit, Dave Watson, has said out loud what has been implied many times: cable companies collectively make up the fourth carrier.

Comcast, Charter, and other cable operators have been branching out into wireless, bundling mobile plans with broadband to attract customers. As they battle declining demand for their core broadband offerings, they are leaning on mobile to fuel growth.

There have already been reports that new customers are increasingly opting for cable companies. It’s not just household customers that these companies are courting, with business subscribers touted as another area of growth.

Federal Communications Commission (FCC) Chairman Brendan Carr gave the trend a nod recently, stating that more new customers are choosing cable companies over wireless carriers. This statement, in a way, justifies the FCC’s decision to nudge EchoStar to put its unused spectrum to use by selling it to other companies.

You’ve got cable companies that are taking a higher percentage share of new mobile wireless subscribers than mobile wireless companies.

Brendan Carr, FCC Chairman, September 2025

While EchoStar’s Boost Mobile won’t cease to exist, it will now rely on a hybrid MNO deal to operate. With a degraded status, its chances of putting up a real fight against the Big 3 are even slimmer.

Cable companies, which lease network access from MNOs to provide mobile services as Mobile Virtual Network Operators (MVNOs), are primed to act as a disruptive force. With MNO customers growing disillusioned with their carriers, cable companies are proving to be a worthy alternative.

However, with EchoStar now out of the picture and the Big 3 owning most of the spectrum, the leverage is now in their hands. The FCC and the Department of Justice (DOJ) have long held the view that a four-carrier market is vital for robust competition, as Recon Analytics’ Roger Entner points out.

While cable companies may be a hot favorite among new customers, the Big 3 still account for more than 90 percent of subscriptions.

Mobile customers more of an afterthought for cable companies.

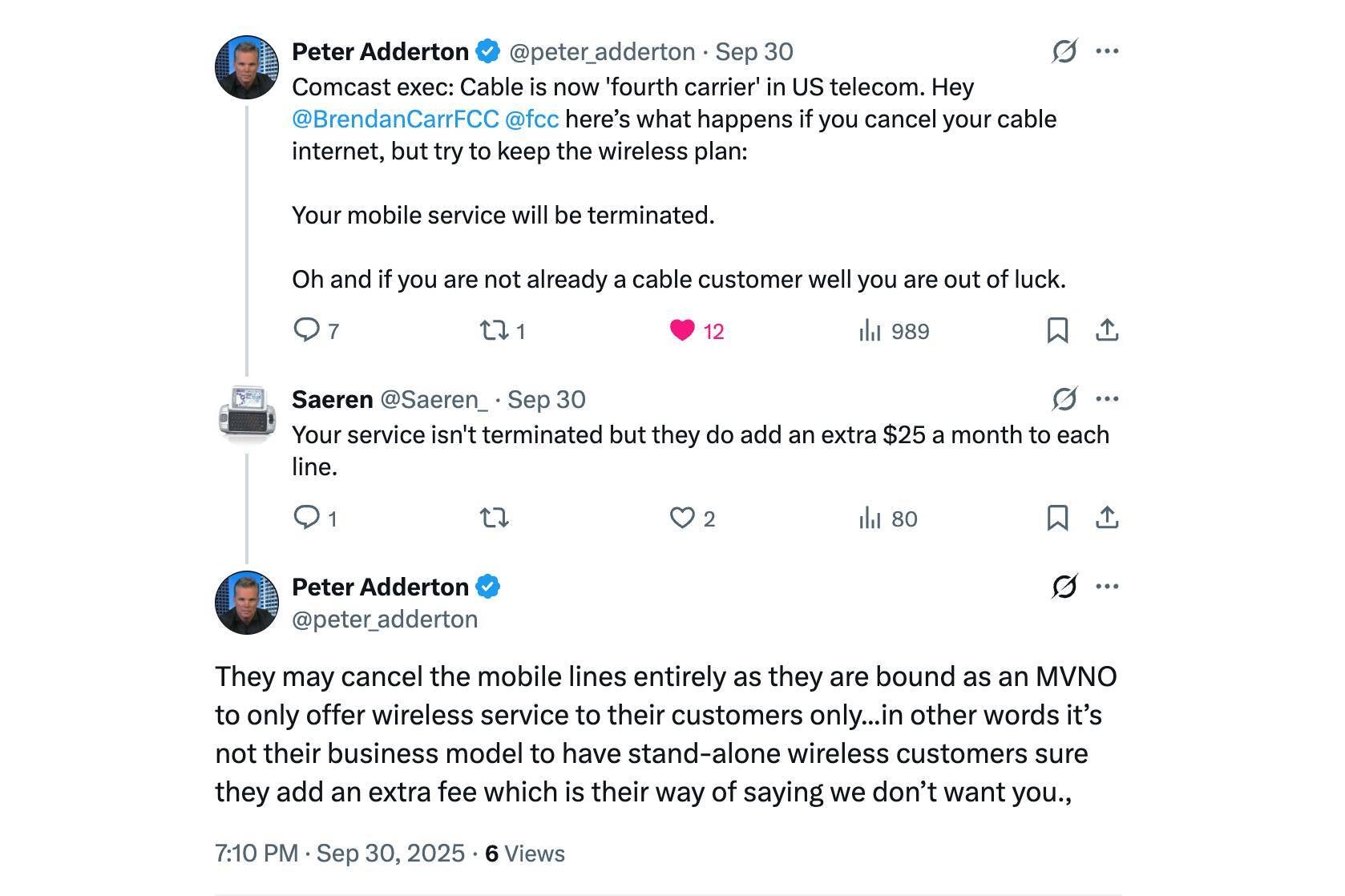

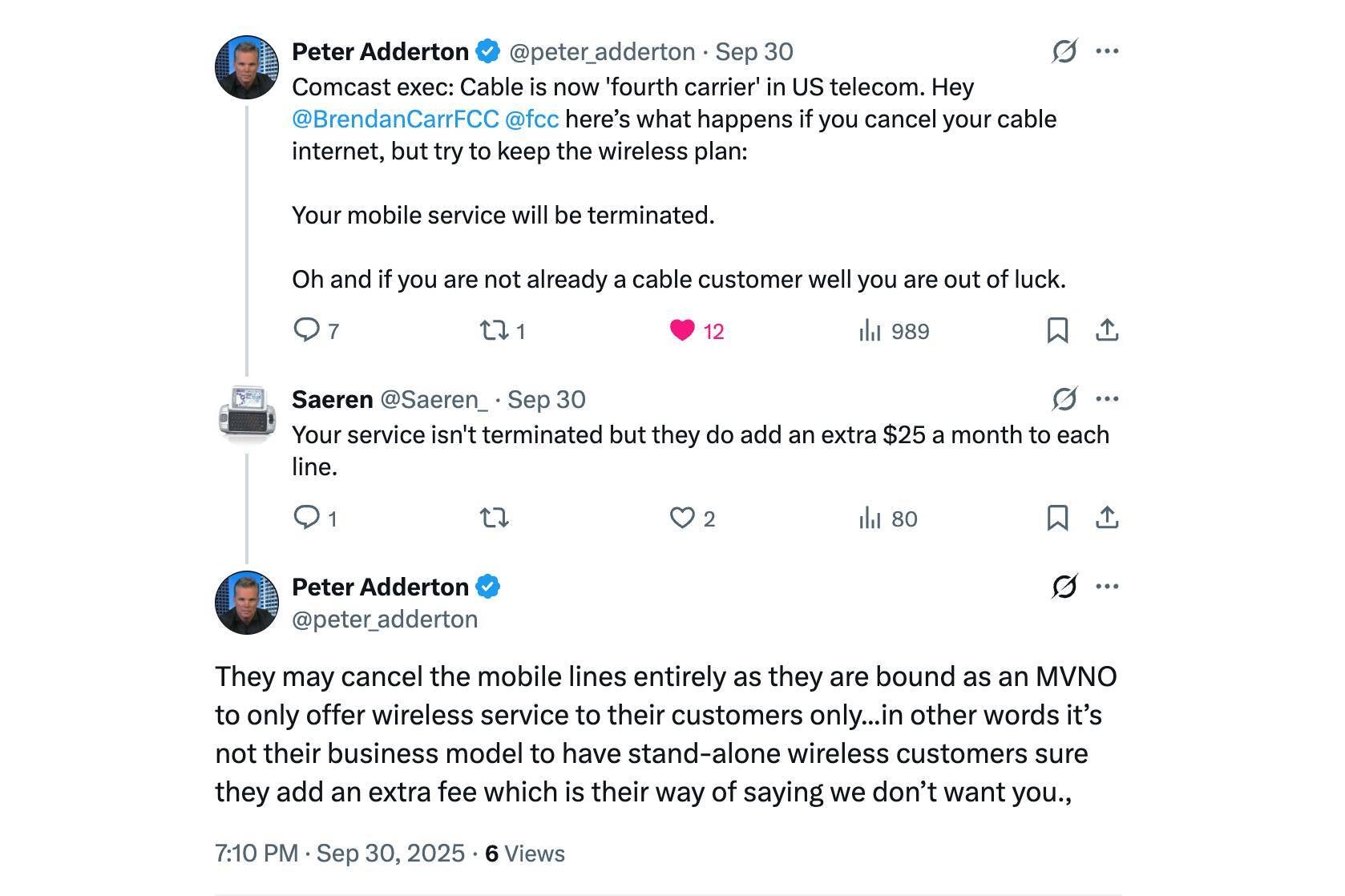

Most importantly, wireless service is a complementary offering for cable companies, according to Peter Adderton, Founder & CEO, MobileX. Their primary business is broadband, and a converged customer is what they are after. For them, mobile customers aren’t that profitable, as MNOs also get a cut. Their wins only strengthen MNOs.

To sum it up, while cable companies do exist as an alternative for customers fed up with AT&T, T-Mobile, and Verizon, it’s important to remember there’s no such thing as the fourth carrier anymore.

Disclaimer: This news article has been republished exactly as it appeared on its original source, without any modification.

We do not take any responsibility for its content, which remains solely the responsibility of the original publisher.

Author: Anam Hamid

Published on: 2025-10-04 23:44:00

Source: www.phonearena.com